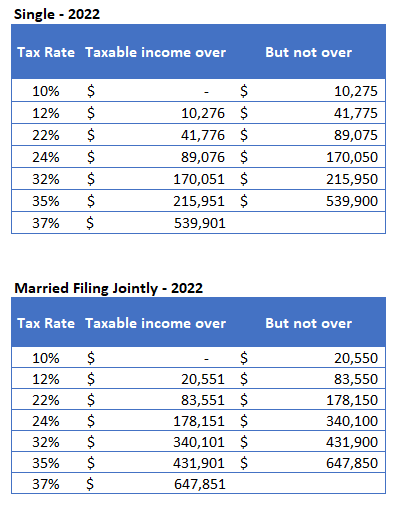

Similarly, brackets for income earned in 2023 have been adjusted upward as well. In tax year 2020, for example, a single person with taxable income up to $9,875 paid 10 percent, while in 2022, that income bracket rose to $10,275. The IRS changes these tax brackets from year to year to account for inflation and other changes in economy. The top tax rate for individuals is 37 percent for taxable income above $539,901 for tax year 2022. For Exampleįor example, a single taxpayer will pay 10 percent on taxable income up to $10,275 earned in 2022. Graduated means you pay different percentage of you income in taxes when you reach a certain income. FICS is owned by FMR LLC and is an affiliate of Fidelity Brokerage Services LLC.In the US income tax system, income tax rates are graduated.

Quotes are delayed unless otherwise noted.

FICS-selected content provided is not intended to provide tax, legal, insurance, or investment advice, and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security by any Fidelity entity or any third party. Content selected and published by FICS drawn from affiliated Fidelity companies is labeled as such.

FICS was established to present users with objective news, information, data and guidance on personal finance topics drawn from a diverse collection of sources including affiliated and non-affiliated financial services publications. All Web pages published by FICS will contain this legend. Content for this page, unless otherwise indicated with a Fidelity pyramid logo, is selected and published by Fidelity Interactive Content Services LLC ("FICS"), a Fidelity company.

0 kommentar(er)

0 kommentar(er)